Several years ago I moved from Atlanta to Seattle to start my first full-time job.

After my first paycheck, I immediately had a bunch of financial goals with no plan to accomplish them.

I just knew wanted a Tesla, an investment portfolio, and zero student debt.

I don't doubt that many people, regardless of income level, have moments where they feel as lost as I did try to prioritize their goals and maximize the return on their spending.

So in this post, I am going to share the template I've been using to decide how to handle my money. I can safely say that without this template setting me straight a few years ago, I'd be leagues behind in my journey to financial independence.

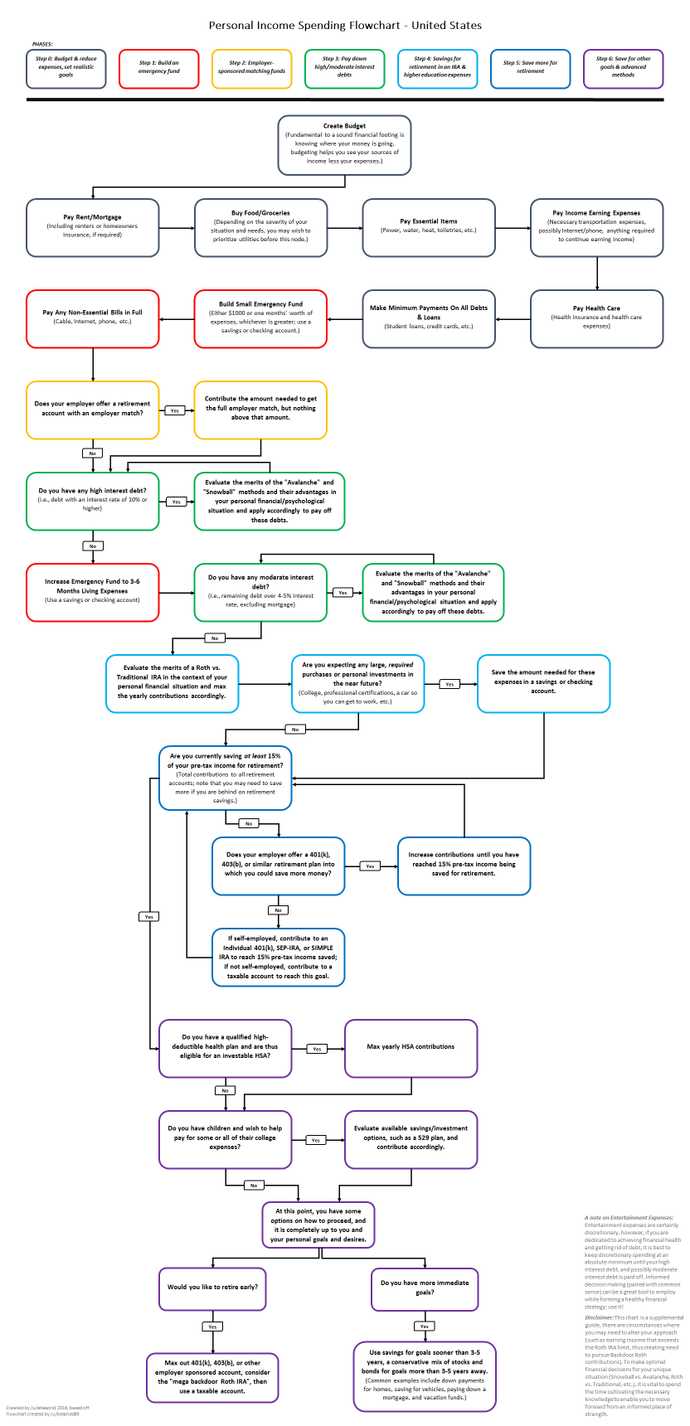

Note! Almost all of the content in this post will be based on this Reddit /r/personalfinance flowchart I found many years ago. I'm going to add some minor revisions and give a brief explanation behind each step in the process.

At a high level the process looks like this:

- Budgeting

- Living Expenses

- Minimum Debt Payments

- Minimum Emergency Fund

- 401K Match

- ** High-Interest Debt Payments**

- Expanded Emergency Fund

- Final Debt Payments

- IRA Contributions

- Big Purchase, Max out Retirement, or Invest

0. Budgeting

Item 0 on the flowchart is budgeting. While I agree that a strong budget is crucial, it doesn't make sense to talk budgeting when I haven't talked about what you're budgeting for, so I'll circle back to this to close out the discussion and tie everything together.

1. Living Expenses

Due to our most primal need to survive, we do this without trying.

Focus on living.

This seems a bit obvious, but the first thing you should always do when you get money is make sure all of your basic necessities are taken care of. This includes things like food, living arrangements, and transportation.

Once you know you have a meal secured and a roof over your head, you can start spending money on other things.

2. Minimum Debt Payments

Debt left unchecked will ruin even the most wealthy and successful people. DO NOT let this be you.

If you have credit cards, loans, car notes, or anything else that requires a monthly minimum payment, PAY IT.

I know it's not very sexy, but interest can get out of hand very quickly and become debt that follows you for decades.

3. Minimum Emergency Fund

You never know when something will come up and demand you put your life on hold. Things like car repairs, a medical expense, or some other unexpected issue could arise at any moment and you'll want to be ready for it.

I recently experienced this firsthand with a dental bill that set me back over $1000.

I would suggest working towards having at least $1000-$2000 stashed away for a rainy day.

4. 401K Match

When explaining a 401K Match, the phrase that basically everyone says is: "Do it, it's free money."

Well, there's a reason everyone says that.

A lot of employers have a program where they'll match your 401K contributions up to a certain percent of your income.

Always take advantage of this.

Although it's an investment from which you won't reap the benefits for a while, you're immediately doubling your money. There are not many other risk-free opportunities like that.

Once you've contributed up to your employer's maximum matched amount, further contributions will not be nearly as impactful, so you may want to focus on some other strategies before contributing more.

5. High-Interest Debt Payments

I talked about minimum debt payments to keep interest in check, but now let's talk about tackling high-interest debt.

In this case, that's any debt that has an interest rate over 10%.

With a rate that high, the most profitable decision you can make is to pay it off. You are guaranteeing yourself a 10% return on your money when the debt is gone.

Debt payments may seem never-ending and a waste of your money, but I promise the financial freedom and relief you get when you've finally paid it all off is well worth it.

Be aware that there are two primary strategies for debt repayment: snowball and avalanche. Do a little research on both and pick whichever works for you.

6. Expanded Emergency Fund

The typical advice is to have 3-6 months' living expenses stored away in your emergency fund. At this point in your process, work towards building that out.

This should ensure that you'll have time to figure things out if something affects your main source of income, or if you just need an extended vacation.

Now if you're like me when I first heard this, maybe you're thinking 3-6 months sounds like overkill. At the end of the day that's up to you to decide, but many experts agree that a 3-6 month emergency fund is a crucial part of financial planning.

7. Final Debt Payments

This is where we tackle any remaining debt you may have. In most cases, this will be something like student loans.

Unfortunately, there's no "one size fits all" approach to handling large amounts of debt. You will need to pay it off at a pace that makes sense for you.

The main advice I can give is to do the math and figure out how long it will take you to pay everything off with continuous monthly payments and stick to a monthly payment schedule you're comfortable with.

Paying off my student loans felt like an insurmountable task that required an unfair amount of money, but speaking from the other side I wouldn't have done a thing differently.

Regardless of how long it takes, make a plan to tackle your debt as effectively as possible.

8. IRA Contributions

At this point, you've taken care of the most painful parts of your finances, so it's time to start investing more in your retirement.

Look into opening a Traditional or Roth IRA and work towards making contributions to that retirement account.

9. Save for Big Purchases, Max Out Retirement, or Invest

This is where things become more of a "choose your own adventure" game.

Depending on your immediate goals you have a few options:

- If you know you have a big purchase (car, home, etc.) coming in the next 3-5 years, just start saving up. Put the money in a High Yield Savings Account and have it on hand for your upcoming purchase.

- Max out your retirement accounts including your 401K and your IRA.

- Take your chances with the stock market and invest the remainder of your money after doing the appropriate research.

The path you decide is entirely up to you. If you're younger and want to take a chance early in the stock market then it may make perfect sense to you. If you're just trying to make sure your retirement accounts are squared away you could do always focus on that instead. If you're planning on starting a family soon then you may want to save up for a down payment on a house.

Just look into each option and see what seems to provide the most opportunity and value for your situation.

Revisiting the Budget

Now that you know how to prioritize you're spending you can build a budget around your personal priorities. The more efficient you can be in your daily life, the more money you'll be able to save.

Take time to understand how much each aspect of your life will cost and budget for it. Even if you only put $50 towards your student loan payments or Roth IRA, decide how much you can consistently contribute and stick to it.

This will lead to consistency and predictability, and as a result, you will able to accurately calculate how far you are from accomplishing your goals.

Take those goals and constantly try and cut down the time it will take to achieve them.

Use This as Guidance, not as Law

Take this advice on how to handle money as a blueprint to build a plan that works for your financial situation. Figure out how to make the most of your income by understanding what you should be prioritizing and how you should be budgeting.

Understanding your priorities and eliminating the guesswork goes a long way in personal finance. It helps you identify the easy wins while helping you avoid early losses.

Did this end up helping you understand how to handle money? Reach out to let me know why or why not!